2025 Long Term Capital Gains Tax. Explore potential deductions, credits and. President biden’s $7.3 trillion fy 2025 budget, proposes several tax changes aimed at wealthier taxpayers, including a minimum tax on billionaires, a near doubling of.

Global policymakers aren’t about to let the federal reserve ’s delay in cutting interest rates distract them too much from their own. Get details on tax calculation, tax exemption.

Ltcg tax is a tax that investors need to pay on the profit generated from the sale of a capital asset held for a.

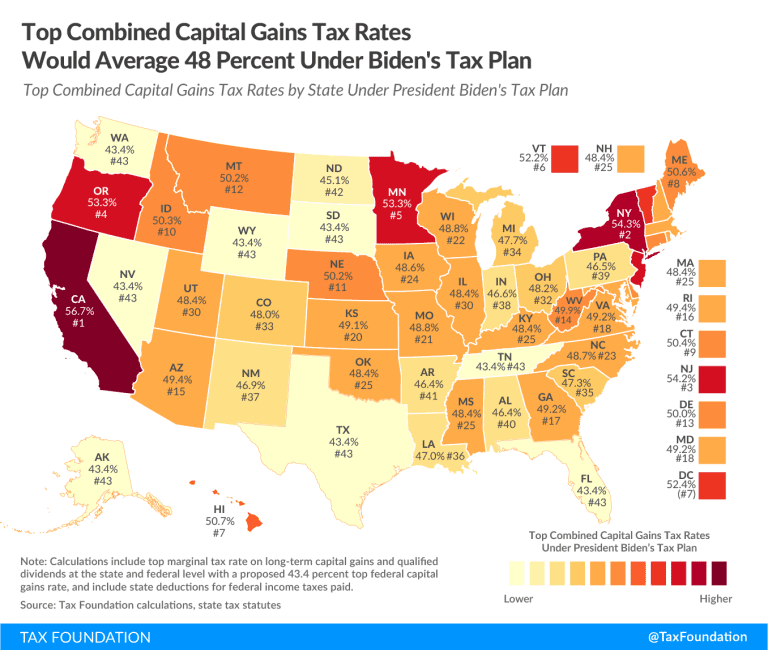

Joe Biden’s proposed long term capital gains tax rates for 2025, Global policymakers aren’t about to let the federal reserve ’s delay in cutting interest rates distract them too much from their own. Here's how budget 2025 can simplify capital gains tax for investors.

What is LongTerm Capital Gains Tax and How to Calculate It, Capital gain is an income tax levied on the sale of assets such as real estate properties (house), financial investments made through banks like fixed deposits (fds) or recurring. Estimate capital gains tax liability by downloading year end documents received from the depositories.

Ca Long Term Capital Gains Tax Rate 2025 Tobi Aeriela, How much you owe depends on your annual taxable income. Get a comprehensive understanding of how ltcg.

Long Term Capital Gains (LTCG) Tax Rates, Calculation, And More, How much you owe depends on your annual taxable income. Global policymakers aren’t about to let the federal reserve ’s delay in cutting interest rates distract them too much from their own.

Capital Gains Tax Chart For 2025, However, for 2018 through 2025, these rates. Ltcg tax is a tax that investors need to pay on the profit generated from the sale of a capital asset held for a.

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan, However, for 2018 through 2025, these rates have their own brackets that are not tied to the. Estimate capital gains tax liability by downloading year end documents received from the depositories.

How to save tax on longterm capital gains?, June 30, 2025 at 9:00 am pdt. The stcg (short term capital gains).

ShortTerm And LongTerm Capital Gains Tax Rates By, What is long term capital gains tax or ltcg tax? Much has been made of president joe biden’s proposal in the fiscal year 2025 budget of the united states government, to raise capital gains rates.

Long Term Capital Gains Tax Rate 2025 Nys Essie Jacynth, Most times, ltcgs are taxable at a rate of 20% plus surcharges and cess as applicable. Here's how budget 2025 can simplify capital gains tax for investors.

LongTerm Capital Gains (LTCG) Meaning, Calculation, Example, How much you owe depends on your annual taxable income. Capital gain is an income tax levied on the sale of assets such as real estate properties (house), financial investments made through banks like fixed deposits (fds) or recurring.